“Online teacher professional learning 2″ Photo by Allison Shelley for EDUimages – CC BY-NC 4.0

HolonIQ just reported that ed tech VC funding is down dramatically, from $20.8B globally in 2021 to $10.6B in 2022. This doesn’t necessarily mean investors have lost interest in ed tech, however. It’s more likely a natural (and healthy) correction from the unprecedented levels of investment that were spurred by school closures and remote instruction during the pandemic.

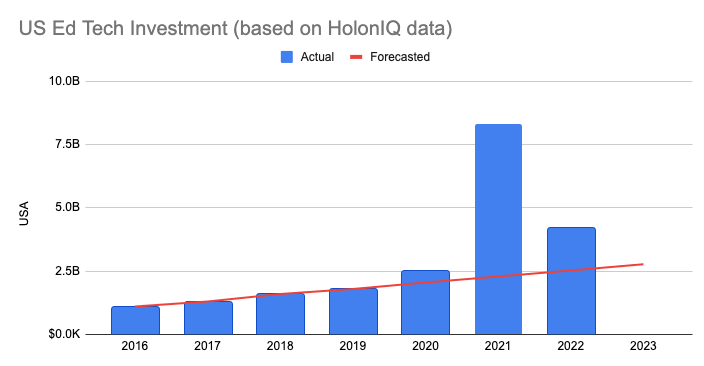

In fact, if you look just at the US, ed tech VC funding in 2022 was still up considerably over what a pre-pandemic forecast would have predicted:

As HolonIQ writes, “…alongside the biggest boom in venture funding’s history (2020-2021), the party’s over and it’s back to fundamentals and outcomes”

This sounds right to me.

As I’ve talked with VCs who have ed tech as part of their investment strategy, there is more curiosity than trepidation about the future of ed tech.

For example, they want to know what technology trends will carry forward in education. Are virtual or hybrid classrooms still important? How are institutions adapting to the online trend? And, of course, is ChatGPT/AI mostly hype or will it have long-lasting impact?

They also want to know what declines in enrollments will mean for the overall health of the industry. Where did all those K12 students go? What are higher ed institutions doing to address both the pandemic-related enrollment declines and the anticipated demographic cliff? How might ed tech help districts or institutions expand or grow enrollments, or economize/optimize their operations?

They also they want to see which ed techs have come out of the pandemic era stronger and more resilient. Who was able to scale during the pandemic boom? And I don’t just mean grow revenue. What companies were able to deliver on their promises to customers as new implementations and user adoption boomed? And what lessons have ed techs learned about running their business? Do post-pandemic projections overestimate new customer growth? Are ed techs seeing significant customer attrition as institutions have re-opened campuses?

These are all important questions for ed tech companies to answer for themselves and incorporate into their near- and long-term strategy. And though I’ve heard anecdotally that ed techs may be having a harder time getting VC attention, my impression is that there is still money to be invested, and still strong interest in this space. Conversations, therefore, may be less exuberant and more focused on the fundamentals that have (or should have) always mattered: e.g. realistic assessments of the market opportunity, proven product-market fit, strategic competitive differentiation, repeatable GTM plans, ability to scale, plans for profitability, etc. As Crunchbase wrote, “Lower investment [in ed tech] looks more like prudence than pessimism”.

Indeed, now may be the beginning of a golden era for ed tech, where advances in technology are meeting a sea-change in attitudes toward online and blended learning. Where the demands and expectations of new audiences of learners in the modern world is creating constructive pressure on traditional educational models. I can’t think of a better time in my 20+ years in education for bright ed tech founders to create products and services that deliver significant human and social impact while building a sustainable — and profitable — business.

These are just my impressions from informal conversations with VCs and ed tech founders. You can add to the story:

If you’re a VC invested in ed tech, how does this match what you’re thinking? What should ed techs be aware of as they seek funding in 2023?

And if you’re an ed tech founder, how are you thinking about the next couple years of your business and your reliance on VC funding?